Productivity Measurement Analysis series – Europe, Q2 2023 by Klaas de Vries

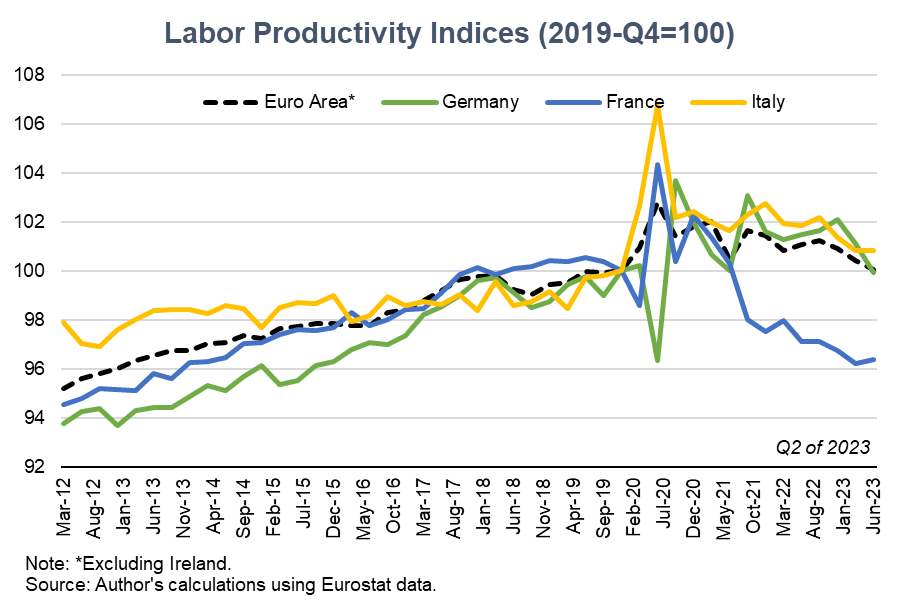

According to figures released on September 7 2023, labour productivity in the Euro Area, defined as real GDP per hour worked, fell in the second quarter of 2023 compared to the previous quarter by 0.2 percent.[1] The fall was even bigger at 0.4 percent when excluding the Irish data, which tends to be quite volatile due to profit-shifting behaviour by US multinationals.[2]

The Q2 decline represents the third quarter of back-to-back declines in labour productivity for the Euro Area, representing the worst streak of quarterly declines since the Global Financial Crisis in 2008/2009. What’s more, the level of labour productivity in Q2 of 2023 is unchanged from Q4 of 2019, in other words, the pre-pandemic baseline. A period of 14 quarters without cumulative productivity growth is unprecedented in the data series. Therefore, we can conclude that the last three years of economic upheaval, including the pandemic, supply-chain disruptions, high inflation and the energy crisis, have had a significant downward impact on productivity. Any upside potential coming from increased use of digital both for consumers (e.g., e-commerce) and producers (e.g., telework) may have had positive impacts but generally have not been enough to offset these headwinds.

Larger economies struggle more with weak productivity growth than smaller ones

A peculiar feature of the weak productivity growth dynamics for the Euro Area is that weakness is skewed towards the large economies (i.e., the big four: Germany, France, Italy and Spain). All of them have seen a significant slowing in productivity dynamics compared to their prepandemic trend, especially in France. Italy, on the other hand, only saw a mild slowing. However, it should be noted that its productivity record over the last decades has been weak, with broad stagnation being the norm. In contrast, many smaller economies, including, for example, the Netherlands, Austria or Portugal, have fared much better and have even seen their productivity growth dynamics improve during the pandemic period compared to the average of the last ten years before that. It might be that due to their smaller size, these economies have been more agile in navigating the period of economic upheaval over the past three years.

Most sectors of the economy show weak productivity trends, with the construction industry being a negative outlier

Weak productivity data are apparent across different sectors of the economy at the Euro Area aggregate level (excluding Ireland), though with important differences across economies. For example, the construction industry is by far the worst performer, with a labour productivity level in Q2 of 2023 that was a staggering 6 percent below the pre-pandemic level of Q4 of 2019. However, then again, the construction sector in Italy is an outlier, which has seen a productivity boom over the last three years – likely related in part to generous government tax incentives for insulating houses. Productivity levels in the manufacturing sector generally have held up well in Germany, Spain, the Netherlands and other smaller economies; though the opposite is the case for Italy and France. This shows that the supply disruptions that hit the Euro Area manufacturing sector have had a variable impact across economies. The same is true for that other economic shock, that is, the rapid shift to remote work during the pandemic, which should be most prevalent in the sector which includes professional and administrative activities.[3] Productivity levels in this sector fell during the last three years in France and Italy, stayed roughly unchanged in Germany and increased in others, most notably in the Netherlands.

Notes

[1] Real GDP at basic prices is used as the numerator, sometimes also referred to as Real Gross Value Added.

[2] In the remainder of this blog we’ll use Euro Area data excluding Ireland when referring to the Euro Area aggregate.

[3] These are sectors M and N in the NACE and ISIC classifications, and include Professional, scientific and technical activities; administrative and support service activities. Another candidate would be sector I (Information and communication), however for this sector it is harder to disentangle the positive demand shock for technology goods and services from the supply shock with more people working remotely.