Blog written by Raquel Ortega-Argilés and Olga Menukhin

The Productivity Lab has released the 2024 edition of The Productivity Institute’s UK International Territorial Level 3 (ITL3) Regional Productivity Scorecard series, which assesses productivity performance across regions and devolved nations in the UK. The 2024 TPI UK ITL3 Productivity Scorecards facilitate comparisons both between and within regions and the ITL1 and ITL3 geographical levels. This new series includes data from various sources, including the latest revised release of the ONS sub-national productivity data, and provides detailed information on productivity drivers for the years 2020, 2021 and 2022. The scorecards cover the three devolved nations of the UK, along with 12 UK ITL1 sub-national areas and 179 ITL3 sub-regional areas.

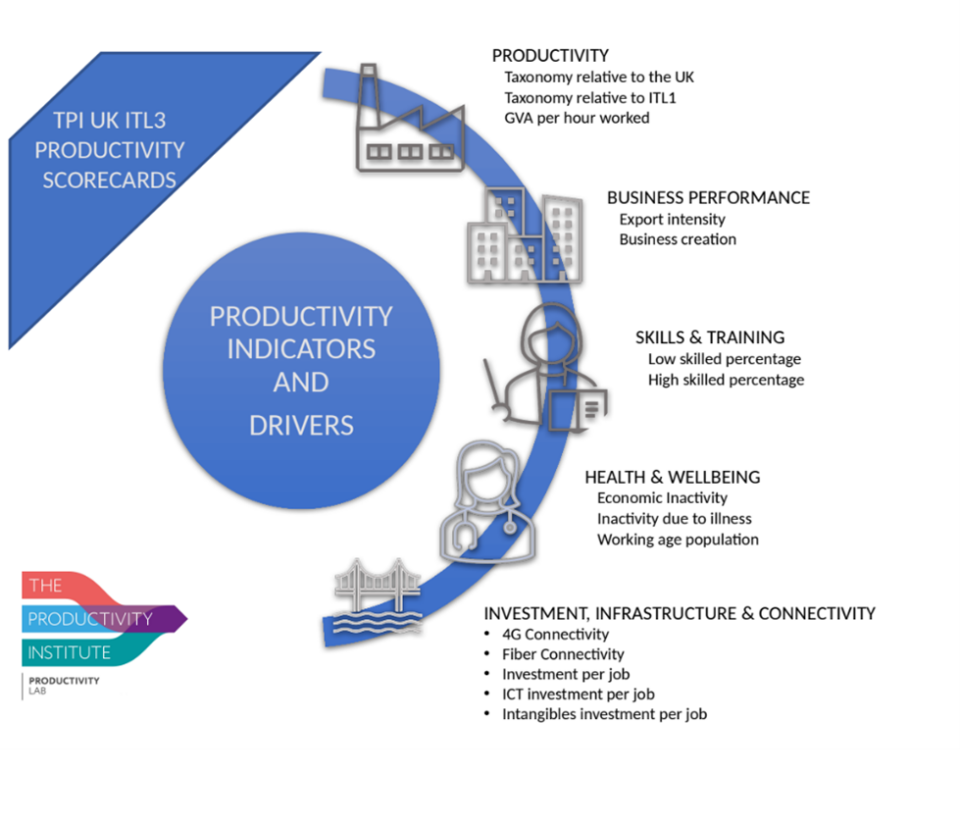

UK ITL3 Scorecard series – Main Productivity Drivers and Metrics

The scorecards examine four regional productivity drivers: business performance, skills and training, health and well-being, and investment and infrastructure. These drivers are assessed using 13 indicators, analysing their short and long-term performance over four main years: 2019, 2020, 2021 and 2022. This analysis aids in the development of strategic initiatives and objectives at the national, regional and local levels.

Figure 1. Productivity Drivers TPI UK ITL3 Scorecard Series

The scorecards are organised into five main blocks, utilising the latest data available.

For productivity performance, the scorecards include the most recent data from the ONS on regional productivity, specifically focusing on ITL3 output per hour worked. “Output” refers to Gross Value Added (GVA), which estimates the volume of goods and services produced by an industry within a specific geographic area, as well as in aggregate across industries in that area. Additionally, the scorecards incorporate regional taxonomies related to the entire UK (reflecting interregional variation) and their own ITL1 categories (indicating intraregional variation).

- Business performance and characteristics are represented by export intensity and the creation of new businesses.

- Regional skills are evaluated based on the percentages of low-skilled and high-skilled individuals within the local workforce.

- Regional health and well-being are assessed using metrics such as the percentage of active working population in the current year, the share of individuals inactive due to illness, and the regional average working age. The data on skills and work-related values is derived from new calculations based on the ONS Labour Force Survey (LFS). This survey, which is a household survey, has been reweighted to enhance the accuracy of labour market information. This reweighting accounts for demographic changes – such as population age, sex or regional composition – in the UK, which have affected employment, unemployment and economic activity across the country.

- Investment, infrastructure and connectivity are illustrated using metrics such as regional investment in 4G, fibre, Gross Fixed Capital Formation per job, ICT per job and Intangibles per job.

The 2024 UK ITL3 Productivity Scorecards incorporate information on ITL1 regions’ productivity drivers and disaggregate these regions at the ITL3 level. More details on the indicators’ descriptions and data sources can be found on Figshare.

Using these indicators is essential for understanding productivity performance in the United Kingdom, including its diverse regions, devolved nations, and local communities. These indicators allow for a thorough assessment of relative strengths and weaknesses compared to other areas within the UK and their specific regions.

When a region shows indicators of poor performance, it may suggest the presence of a bottleneck that hinders productivity growth in that area. Such situations can uncover underlying issues that need to be addressed, potentially highlighting specific policy areas that require further investigation and targeted interventions to boost regional productivity and economic competitiveness. Engaging in this in-depth analysis can lead to more informed decision-making and tailored strategies for productivity improvement across different geographical levels.

There will be ITL1 regions that may underperform in some indicators, and the explanation could be found in the uneven performance of their ITL3 areas, with only a few of them being responsible for the below (ITL1) regional performance. The opposite can also be seen; London and the South East are areas that overperform in many of the scorecard indicators, but this overperformance may eventually hide the severe underperformance of some of their ITL3 areas.

Key factors

Improving productivity in sub-national areas is a complex challenge that requires a multifaceted approach. It involves identifying and addressing the key factors that drive productivity, such as infrastructure, education, research and development, innovation, and entrepreneurship. Achieving overall performance necessitates strong performance in most of these areas.

For example, investing in infrastructure can enhance connectivity and accessibility, leading to increasing productivity by lowering transportation costs and improving market access. Likewise, investing in education, research, and development can cultivate a more skilled workforce and foster innovative ideas, ultimately boosting productivity over time.

To boost performance in sub-national areas effectively, it is crucial to implement a comprehensive strategy that tackles all major drivers of productivity. This holistic approach will ensure sustainable improvement and drive success.

2024 TPI UK ITL3 Scorecard series

The 2024 TPI UK ITL3 Productivity Scorecards are built with the latest productivity data available, the ONS sub-regional productivity data release of June 2024. It is worth noting that the ITL3 data could be affected by unmeasured differences in regional prices and smaller samples (see more on the ONS website). Figure 2 illustrates the taxonomy used in our scorecards to categorise UK ITL areas according to their productivity performance. Each category of the taxonomy (Steaming Ahead, Losing Ground, Catching Up and Falling Behind) is defined based on Gross Value Added (GVA) per hour worked in 2022 and the productivity growth change from 2008 to 2022. By comparing ITL areas to the UK average productivity values, they are assigned to a taxonomy category. We provide the taxonomy for ITL1 areas in Figure 2 for their comparative analysis based on the same productivity data used in ITL3 scorecards. Similarly, ITL3 sub-regions within each ITL1 area can be categorised in this taxonomy to provide a more detailed analysis and comparison within- and between ITL1 regions.

Figure 2. UK Subnational Productivity Performance, 2022

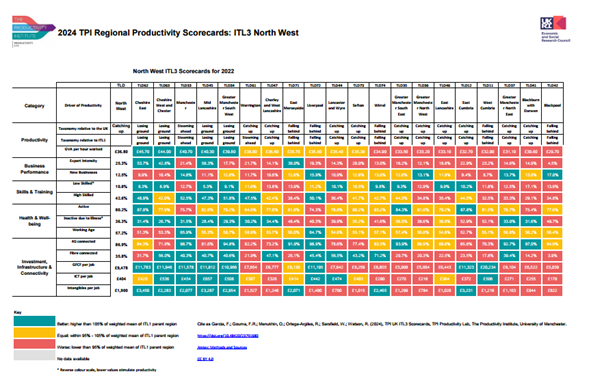

The TPI ITL3 regional productivity scorecards highlight the significant variation in productivity across different regions in the UK. By comparing areas within the ITL3 regions, we can gain valuable insights into the factors contributing to these productivity differences. For instance, we illustrate this with an example from the North West, as shown in Figure 3 below.

Figure 3. 2024 UK ITL3 Productivity Scorecard. North West 2022.

In 2022, the North West ITL1 area was categorised as a Catching Up region, as presented by higher percentage growth in productivity for the years 2008-2022 relative to the UK regional average but a lower GVA/hr in 2022 than the average UK ITL1 region, as illustrated in Figure 3.

In the North West, the Manchester area is identified as a “Steaming Ahead” region, having outperformed the UK regional average in productivity during 2022 and showing growth since the recession. In contrast, Cheshire East, Cheshire West and Chester, Greater Manchester South West, and Mid Lancashire also exceeded the UK regional average in 2022 productivity but are classified as “Losing Ground” due to their slower growth since the recession.

There is a significant group of areas categorized as “Catching Up,” which show lower productivity rates in 2022 compared to the UK regional average but have demonstrated higher productivity growth rates since the 2008 recession. This group includes Sefton, Warrington, Lancaster, Wyre, and Greater Manchester North East.

Lastly, areas that require major attention are those classified as “Falling Behind.” These regions, including East Merseyside, Liverpool, West Cumbria, and the Wirral, exhibit both low productivity growth in 2022 and lower growth rates since 2008.

Acknowledgement

We acknowledge the expert advice and suggestions received from several members of our Regional Productivity Forums and the TPI Productivity Lab experts group members in different editions.

Note:

iThe TPI UK ITL1 and ITL3 Scorecards are adapted and methodologically modified from Jordan and Turner’s The Northern Ireland Productivity Dashboard 2022, inspired by the CBI/KPMG Scottish Productivity Index 2021.

Dataset citation

Garcia, F., Gouma, R., Menukhin, O., Ortega-Argiles, R., Sarsfield, W. and Watson, R. (2024) TPI ITL3 Regional Productivity Scorecards – 2024 Edition, The University of Manchester.