Productivity Measurement Analysis series – Euro Area, Q2 2024 by Klaas de Vries.

According to figures released on 6 September 2024, labour productivity in the Euro Area, defined as real GDP per hour worked, broadly speaking flatlined in Q2 2024 compared to the previous quarter.[1] This follows stagnation in the first quarter of 2024, a figure that was downwardly revised with this release. Due to favourable base effects, the figures show a small increase compared to the same quarter of last year.

Table 1. Euro Area (excl. Ireland)

| (1) | (2) | (3) | |

| Q2/2024 | Q2/2024 | vs Q4 of | |

| q/q | y/y | 2019 | |

| Real GDP (at basic prices) | 0.22% | 1.1% | 4.1% |

| Persons employed | 0.19% | 0.9% | 4.0% |

| Total hours worked | 0.24% | 0.8% | 2.8% |

| Labour productivity (per worker) | 0.03% | 0.2% | 0.1% |

| Labour productivity (per hour worked) | -0.01% | 0.3% | 1.3% |

The Euro Area economy (excluding Ireland) expanded by about 0.2 percent on the previous quarter, slightly below last quarter’s 0.3 percent increase. German GDP contracted, but this was offset by a 1 percent increase in the Netherlands. Spain continues to outperform the other large economies, with another 0.8 percent increase. On a sectoral basis the GDP expansion across the Euro Area was largely driven by service sector industries, as construction output declined and manufacturing activity took another hit.

The labour market remains strong, however, and this explains the flat labour productivity readings of the last few quarters. About 350 thousand jobs were created on average for the last four quarters, showing that businesses in the Euro Area economy continue to create lots of jobs. However, about half of those 350 thousand persons who entered the workforce in the Euro Area over the last four quarters joined the burgeoning ranks of public administration, education and healthcare. This could at least to some extent explain the flat labour productivity readings, as labour productivity growth in those industries are, by construction, inseparable from output growth.

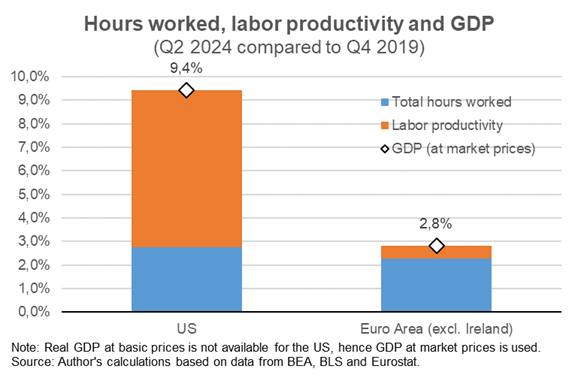

European economies are progressively releasing their revised national accounts statistics. These data broadly show a somewhat higher level of GDP, and hence labour productivity, as the data on hours worked are typically less subject to revision. However, the trajectory of labour productivity in the Euro Area and most of its constituent economies remains unchanged with the new data. Labour productivity barely moved during the last few years. The Euro Area economy has grown by about a total of 3 percent since the last quarter of 2019, but this was almost exclusively down to increased labour efforts, not productivity. Compare this to the US, where labour input increases were broadly similar as those in Europe, and yet overall GDP has grown by more than 9 percent. This underscores the urgency of Europe’s problems with its competitiveness (see figure below).

[1] Real GDP at basic prices is used as the numerator, sometimes also referred to as Real Gross Value Added; The Euro Area aggregate referred to in this blog excludes Ireland due to volatility in the Irish GDP data which are unrelated to productivity measurements.