Professor Nigel Driffield is Professor of International Business at Warwick Business School and the lead of our Organisational Capital research theme. He details how the UK tracks Foreign Direct Investment (FDI) data in this blog, which has been co-written by Xiaocan Yuan, a post-doc Research Fellow at at WBS and Fernando Gutierrez Barragan, Head of Trade and Investment at Moody’s Analytics.

Tracking the productivity benefits of Foreign Direct Investment (FDI) to the UK means analysing beyond the simple investment decision, looking a company’s motives, the type of market served, sectoral distribution and so on.

Our research uses FDI data extracted from the Orbis Crossborder Investment database provided by Bureau van Dijk (BvD, now part of Moodys). This is a bespoke, global database covering both greenfield and Merger and Acquisitions (M&A) FDI.

This allows us to explore the latest intelligence on FDI flows into the UK, and what that means for productivity, in our research, which is a collaboration between Warwick Business School and Moody’s Analytics funded by The Productivity Institute.

By doing so, we are able to disentangle the relationship between inward FDI and UK productivity growth, especially in the context of the changes to inward investment climate in the UK resulting from Brexit and COVID-19.

Examples on how various variables can be utilised can be found in our regular series of notes by tracking the recent changing patterns and focusing on certain aspects each time of inward investment in the UK.

- In the first briefing, looking across the UK as a whole, we start with an assessment of the overall trend and aggregate change of both inward greenfield investment and inflows of UK cross-border M&A deals since the Brexit referendum. We study the source market composition through exploring the variations by source country of the inward investors.

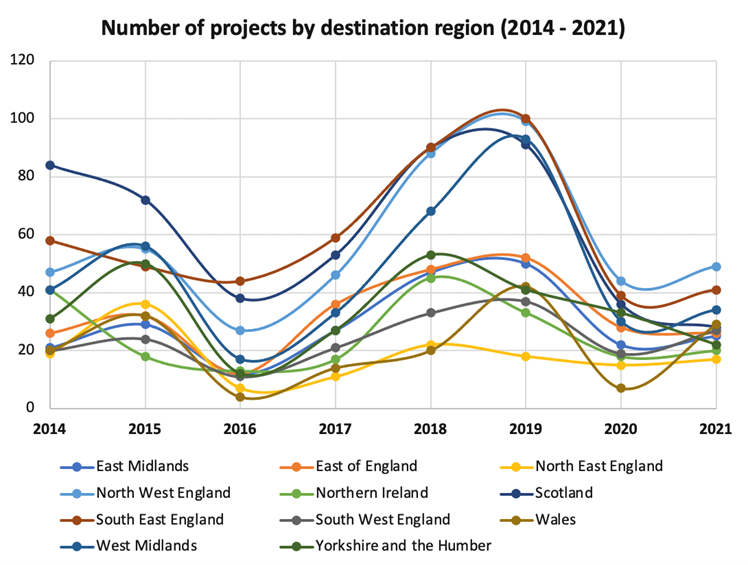

Figure 1 Illustrates the impact of Brexit – and the uncertainty around Brexit on inward investment into the UK in terms of new projects.

- In the second briefing, we go on with delving into the regional variations in inward FDI to understand its differential impacts across the UK regions, revealing the uneven spatial distributions of investments across the country. We then proceed to explore the patterns across industrial activities for the different regions.

- In the third briefing, we focus on the changes in the makeup of FDI from the perspective of project motives, project type, type of market served, showing that the majority of the new projects landing in the UK are primarily to serve the UK local market. All the three briefings finish with the implications of our findings on our understanding of the UK productivity puzzle.

One important feature of this data is that it provides information on motives for greenfield FDI projects, which allows us to analyse the structure of such investments and explore FDI spillover effects that accrue to the host locations, particular in terms of productivity growth. Compared with other sources of investment data, another advantage of this database is that each investment record can be easily matched to its investing company’s corporate and financial information using a unique firm identifier in the standard Orbis database.

This database allows us to collect more firm characteristics and financial information to carry out more typical academic research, which is a rich and comprehensive firm-level dataset also offered by BvD. It covers financial, economic, and other firm-level information from various sources on an annual basis, including official bodies, such as the Companies House in the UK, and similar commercial and official registries in other countries. Specific types of company information cover contacts, industry, ownership, key financials, employees, and a set of ID numbers to facilitate firm-level analysis.

However, this database is not without its drawbacks. One limitation of the data is that there are specific project types which are not included, such as franchises and concessions. Franchising is generally an investment by a local company and as such, constitutes domestic investment, as opposed to foreign investment, while concessions are treated in the same way as franchises as they involve companies leasing space, rather than making a direct investment.

What kind of data is tracked, collated and analysed?

BvD tracks investment records on a daily basis, collecting the announced, completed and cancelled/withdrawn FDI projects and cross-border M&A deals, as well as information on rumours/intentions to conduct an FDI project and M&A transaction since 2013. A project is recorded when there is any opening, expansion, co-location and relocation of data centres, sales offices, shared service centres, headquarters, distribution centres, experience centres, and research and development centre.

In the case of M&A deals, the investing (acquiring) company is the legal entity undertaking the transaction and is not necessarily the global ultimate owner (GUO). The deal types tracked include acquisitions; mergers; de-mergers; institutional buy-outs (IBO); joint ventures and minority stakes. To qualify for inclusion, the transaction must involve a minimum 10% foreign ownership.

For each investment record, we can identify project/deal overview, project/deal number, investing company name(s), the destination/target countries, etc. The records included are assigned a project/deal status and a corresponding date (including rumour date, announced date, completion date, expected completion date, completed assumed, cancelled/withdrawn date, and postponed date). Typically, these start with rumour, followed by announced and finally completed.

Additionally, in the case of greenfield FDI projects, a “business function” is usually assigned to the projects, describing the type of operations established via the focal projects. These include data centre, sales office, shared service centre, regional headquarters, distribution centres, experience centres, research and development centres, and others.

Information about company involved in the investment can also be found in the database, including contacts, industry, ownership, key financials, employees, stock data, ID numbers, legal and account information.

Greenfield FDI Projects

The BvD research team uses multiple news aggregation products and newsfeeds to identify potential FDI projects. Once a project has been identified, the researcher will then conduct further detailed research, collecting additional information from reliable websites and sources. Where possible, the research team will locate official documentation such as press releases, SEC filings or stock exchange announcements that will be used to create the FDI project record. If it is not possible to find official documentation, at least two news articles are used to create the project.

Mergers & Acquisitions

The research teams use a range of data sources to collect the data required to be able to input deals. These sources are utilised daily, and researchers download or receive information every day via newsfeeds, which are subsequently filtered and processed. Once a researcher has found a “lead” for a deal in the source material, they will proceed to collect further information from other reliable websites and sources to be able to add the deal information to the system. Wherever possible, researchers will locate press releases or official documents relating to the deals they create or update and will endeavour to find at least two source documents per deal.

A deep dive into the database

The Orbis Crossborder Investment data provides detailed information on the various FDI project determinants including project types and subtypes, the deal types and status of the project. These are detailed below:

Project types are classified into four categories according to the aim of the project as follows:

- New – a new operation, whether it be a manufacturing plant, regional headquarters, sales office, and so on.

- Expansion – typically described as additional capital or jobs being invested or created into an existing project (that is, new staff hires, adding a new line to an existing manufacturing plant, and so on).

- Co-location – the same company (investor) investing into the same location (city) in a different business activity (for example, XYZ company could be setting up a regional distribution centre as well as a manufacturing plant). Sometimes companies will create a new warehouse to complement an existing manufacturing plant.

- Relocation – refers to a project that has been relocated from one location to another.

Deal types are classified into six different groups according to the distribution of equity as follows:

- Acquisition – defined as a deal in which the acquiror ends up with a stake of 50 per cent or more in the target’s equity. Even deals involving the purchase of a very small stake will be defined as an acquisition if the final stake held by the acquiror is 50 per cent or above.

- Merger – defined as a deal in which a one-for-one share swap takes place and as such, the deal involves a ‘merger of equals’. If the swap is not on equal terms, the deal will be defined as an acquisition. Most deals that are described as mergers are actually acquisitions.

- Demerger – defined as a deal in which a company launches a new and independent entity that will trade autonomously but will continue to be owned by the company’s shareholders. Although the new entity has been separated from the main business, it has not been sold and no change of ownership has taken place.

- Institutional buyout (IBO) – defined as a deal in which a private equity firm has purchased a stake of 50 per cent or more in a company. As with acquisitions, even deals involving the purchase of a very small stake will be defined as an IBO if the final stake held by the acquirer is 50 per cent or above. The only difference between a standard acquisition and an IBO is that the acquiror in an IBO is a private equity firm.

- Minority stake – defined as a deal in which the acquiror has purchased a number of shares in the target and the resulting final stake is less than 50 per cent. A deal involving the purchase of a 2 per cent stake could be defined as an acquisition if the acquiror’s overall final stake is 50 per cent or more, such as if a buyer increases its stake from 49 per cent to 51 per cent.

- Joint venture – defined as a deal in which two or more companies create a new, jointly-owned entity. The two or more companies that have established the new entity continue to exist.

The dataset also offers additional information about the project motives or markets served (Project subtypes).

Motives

- Location attractiveness – selected when the company has identified the country or city’s general attractiveness as a place to be located.

- Domestic market potential – selected when the company has identified that demand in this market/country/city is growing or is on the cusp of growth.

- Real estate availability – should be selected when the company has identified a building, business park, and so on, as the reason for locating itself in the area.

- ICT infrastructure – selected when the company has identified the location’s internet or telecoms infrastructure as the reason for locating itself there.

- Industry cluster – selected when the company identifies the location as having multiple similar companies or companies working on similar projects in the area.

- Transport and utility infrastructure – selected when the company has identified the location as being easily accessible by any method of transport and also having good physical utilities infrastructure, including electricity grids, water works and so on.

- Government support – selected when the company has cited non-financial support from the local investment promotion agency (IPA) or government body as a reason for locating there.

- Lower costs – selected when the company identifies lower cost labour or other resources when compared to competing locations.

- Natural resources – selected when the company has cited the natural resources the locality has to offer as a factor in its decision to locate itself there.

- Supply chain – selected when the company cites a location as being desirable because its suppliers are close by.

- Market access – selected when the company has identified a location as beneficial due to its location being close to existing customers and potential clients.

- Business environment – selected when the company has identified the wider economic and political climate in the country as a reason to locate there.

- Skilled workforce availability – selected when the company has stated that a qualified, skilled or appropriately educated workforce in the area was one of the reasons it chose to establish itself there.

- Language availability – selected when the company has stated that a multilingual workforce in the area was one of the reasons to establish itself there.

- Universities or researchers – selected when a company has decided to locate in a city or country to be close to institutions of research and learning.

- Technology & innovation – selected when a company has identified a location as being an area of high innovation, development and technology advances.

- Access to finance – selected when a company has identified the ability to raise significant money by being listed in the location as a key reason for choosing to invest there.

- Taxation – selected when a company highlights the attractiveness of the local taxation structure in relation to corporate tax planning.

Markets served

- Domestic – this means the project is primarily designed to serve the local market of the area where the investment will be.

- Regional – a project will be classified as serving “Regional” markets when the article description stipulates that the project will serve multiple countries.

- Global – a project serving “Global” markets will typically serve a number of regions or several regions across different continents. These projects also tend to be a highly mobile having considered multiple global locations.

- Not specified – added in instances where it is not possible to determine the market(s) being served.

Dates

All deals on Orbis Crossborder Investment are assigned a deal status and a corresponding date. Typically, these start as Rumour, before moving to Announced, and finally, to Completed. Each of these statuses is assigned a date.

- Rumour date – this is the date on which the project/deal was first mentioned or identified in the public domain. If the first mention of the project/deal is when it is officially announced, that date is entered as both the rumor and announced date.

- Announced date – the date when details of the project/deal have been provided or when the investing company or companies involved has confirmed that the project is to go ahead.

- Completion date – the date when the company “has opened” its project or it is deemed to be operational. From an M&A perspective, this is the date when the deal has officially completed. It will be added when the deal has been announced as completed. In certain circumstances, it will be added when the deal has received all necessary approvals to go ahead. Unfortunately, companies seldom announce a deal’s completion with as much fanfare as the original announcement, and thus many deals are left as Announced rather than Completed. If a researcher suspects that a deal may have completed, every effort will be made to locate the information.

- Expected completion date – the date on which the project/deal is expected to be completed.

- Completed assumed – this field will be auto-populated 18 months and a day after an Announced project is recorded, or once an expected completion date has passed. This status is applied once an expected completion date has passed or once a deal has been in an Announced, Pending (all options) or Unconditional status for a period of 24 months without being updated.

- Cancelled/withdrawn date – the date on which a previously announced project is formally cancelled. For M&A deals, this will be added to any deal when the deal status is changed to Withdrawn. The date will correspond with the recorded date of the withdrawal.

- Postponed date – the date on which a previously announced project/deal is formally postponed.

Business function

All new projects added are assigned a “business function”, which generally describes the type of operation being established via the FDI project. The options that are not defined by a North American Industry Classification System (NAICS) code, and their definitions, are as follows:

- Data centre – a specific centre that has been set up to process, store and handle data, including library archives and news syndicates specialising in the supply of data.

- Sales office – an office where sales consultants are based, and where they meet with prospective clients by appointment. This should be distinguished from “Retail” as this involves a customer approaching a retailer to purchase a product.

- Shared service centre – any specific centre set up to provide professional services (also known as outsourced services).

- Regional headquarters – covers a company establishing a new headquarters via FDI.

- Distribution centres – covers the establishment of logistics hubs and warehouses via FDI.

- Experience centres – locations that provide customer support services to clients by allowing them to learn, test and experience the company’s products.

- Research and development centres – locations that are established by companies to carry out initial research, development and testing of their products. Innovation centers are also included within this category.

All other projects such as hotels, banks, manufacturing plants, and so on, do not require a business function to be assigned.