Disappointing numbers for Q2 suggest that productivity has not yet joined the UK recovery

An analysis of the Q2-2021 Flash Estimates of Productivity for the UK by the Office for National Statistics by Bart van Ark, Managing Director, The Productivity Institute & Professor of Productivity Studies, University of Manchester.

UK productivity growth dropped by 0.5 percent in Q2, but should advance modestly for remainder of 2021 and into 2022

Key observations for the outlook on productivity for 2021

- The drop in output per hour by 0.5 percent from April-June 2021 (Q2-21) compared to the previous quarter (Q1-2021) indicates that productivity growth has not yet returned as a contributor to the recovery of the UK economy.

- Negative reallocation effects from the reopening of low-productivity sectors after lockdown outweighed any productivity gains within sectors. This reallocation is likely to continue to impact on the productivity outlook for the next two quarters.

- Productivity growth within sectors, which varied but was flat in the aggregate, suggests the economy is still operating below the already slow pre-pandemic productivity trend of 0.4 percent.

- The effects of digital transformation during the pandemic provide some impetus to modestly faster productivity growth in 2022 and beyond at between 0.5 and 1 percent, dependent on the pace and quality of investment in physical and human capital

Summary of the data from the Office of National Statistics

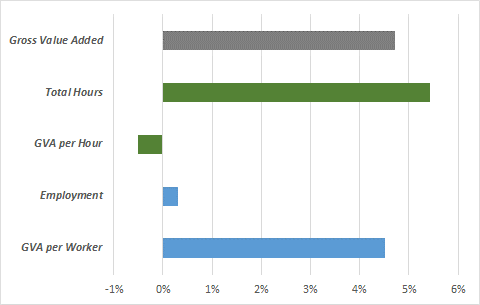

Labour productivity, measured as gross value added per hour, declined by 0.5 percent during the second quarter of 2021 (Q2-21) compared to the previous quarter (Q1-21) according to the latest estimates by the Office of National Statistics, UK productivity flash estimate: April to June 2021 (17 August 2021. This decline reflects from a strong increase in output (4.8 percent) in combination with by an even stronger increase in working hours (5.4 percent).

The rise in working hours primarily resulted from a reduction in furloughed hours of current workers rather than the hiring of new workers (which increased by only 0.3 percent). Output per worker therefore increased at a strong 4.6 percent compared to the previous quarter. (see Chart)

The fall in hourly productivity compared to the Q1-21 can be entirely attributed to a partial recovery of output and employment in sectors, such as hotels & catering and recreation & culture, which suffered most from the lockdowns. The reopening of those sectors, which are characterised by relatively low levels of labour productivity, more than offset any productivity gains made during the quarter within individual sectors.

Output, Labour Input and Productivity, Q2-21 (April-June) over Q1-21 (January-March), %

Source: Office of National Statistics, UK productivity flash estimate: April to June 2021, 17 August 2021.

Productivity growth within individual sectors of the economy was on average unchanged in Q2-21:

- There were positive productivity effects from pent-up demand in wholesale & retail trade and in hotels & catering. But these were offset by negative productivity growth in other sectors.

- Fourteen of the 26 industries showed an increase in productivity, whereas 12 industries showed a decline.

- Some industries did well on labour productivity growth, in particular agriculture (11%, offsetting a fall in the previous quarter), machinery and equipment (8%), wholesale and retail trade (5.3%) and public services (5.4%).

- Negative productivity effects were observed in particular in mining (-15%), chemical and pharmaceutical products (-10%), transport equipment and recreation & culture (both at -11%).

- The big outliers were, on the one end of the spectrum, hotels & catering which showed a productivity increase of 26% (resulting from an 88% percent recovery in output and 49% percent increase in hours worked). At the other end, recreation and culture showed a productivity decline of almost 12%, as output recovered at only 10% while total hours increased 26%.*

According to ONS, output per hour is now just 0.6 percent above the pre-pandemic (average of 2019) level. Many of the gains in 2020 were due to positive reallocation effects, which will be offset by negative effects during 2021. Together with the weak productivity performance within sectors, it may be concluded that “true” productivity growth (that is, after removing the reallocation effects) has so far not shown any improvement relative to the pre-pandemic trend of about 0.4 percent per year.**

Outlook for productivity

The rather disappointing productivity results for Q2-21, combined with details from recent GDP estimates for Q2-21 by the Office of National Statistics (ONS) and the Summer forecast for the UK economy by the National Institute of Economic and Social Research (NIESR) give cause for a somewhat more cautious outlook for productivity growth later in 2021 and beyond.

- As the effects of the lockdown on the reopening of sectors, such as hotels & restaurants and recreation & culture have not yet fully played out, it is plausible to expect ongoing negative reallocation effects in the next few quarters as these sectors continue to grow their share in the economy to a pre-pandemic normal.

- Some positive pent-up demand effects will continue to fuel GDP growth in Q3-21, and perhaps even into Q4-21, helping a pro-cyclical productivity recovery.

- However, so far increased consumption has been driving much of the recovery in GDP while investment growth has remained quite sluggish, and was even negative in Q2-21. This can have negative implications for productivity growth going into 2022.

- While there seems no immediate positive impact from the rise working from home during the pandemic on productivity, such effects may become clearer once industries and firms settle on the most optimal hybrid methods which combine work from home with work in offices.

- There is much stronger evidence that digital transformation, more broadly, has continued to benefit productivity growth during the pandemic, especially in industries that are intensive users of such technologies (see De Vries et al, 2021). This may bode well for multifactor productivity (MFP) growth, which measures output growth over the combined growth of labour and capital input in 2022 and beyond.

- One key uncertainty in the outlook for productivity is the combined effect of productivity growth in incumbent firms, new firms and firms that will exit. In a typical economic recovery, existing and continuing firms benefit from rising investment, new firms initially accelerate output growth faster than employment, and exiting firms are the least productive. While some of those productivity effects may play out over the course of 2021 and 2022, the growth of new businesses hasn’t always been in sectors with the greatest potential for productivity growth. Moreover, the number of business deaths has so far been relatively small because of the business support programmes. The gradual unwinding of those programmes may not show the typical cleansing effects on productivity as normally seen in the aftermath of a recession.

- Another important uncertainty for the productivity outlook is how the balance between negative and positive effects on the labour market will play out. On the negative side, labour scarring due to a gap in training of furloughed workforces and potentially longer-term effects from damage to education of new entrants in the labour market, may negatively impact on productivity. On the positive side, rising labour shortages especially for blue collar workers and those working in some personal services may lead to wage increases and attract more qualified workers, which in turn might incentivize companies to invest in automation and workforce skills.

Overall, productivity growth for the remainder of 2021 will at best be modestly positive but will most likely end up below an 0.5 percent increase compared to 2020. In 2022 and beyond effects of investment and digital transformation may contribute to faster multifactor productivity growth, and push productivity into the 0.5-1 percent range per year.

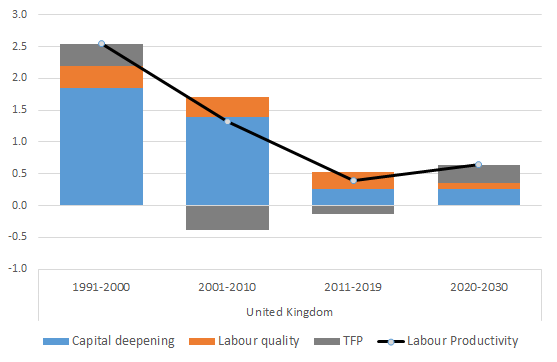

In an optimistic scenario, as described in NIESR’s Summer forecast (pp. 15-16), labour productivity will increase at 0.7 percent in 2022 and then average at 1 percent per year between 2023-2025. In a more sobering scenario obtained from The Conference Board Global Economic Outlook, average annual labour productivity growth from 2020-2030 will only be 0.6 percent per year, as both labor quality and capital investment for working hour could weaken even though total factor productivity from automation and digital transformation could further improve (see De Vries et al, 2021).

Contributions of capital deepening, labour quality increase and multifactor productivity (TPF) to labour productivity growth in the United Kingdom, 1991-2030 %

Source: The Conference Board Global Economic Outlook. See De Vries et al, 2021

Note:

In addition to the regular warning of upcoming data revisions, the productivity figures for Q1-21 and Q2-21 need to be interpreted with some caution because of planned changes by the Office of National Statistics in the population weights used in the Labour Force Survey. Also the introduction of double deflation for output and inputs as of October 2021 may have an impact on productivity growth rates. At the aggregate level of the the impact of those adjustments are likely to be rather small, but they could be larger for individual industries. The double deflation method will show a slightly stronger productivity performance during the pre-pandemic decade, but thereby also create a higher level of productivity on which future productivity growth will be based.

Footnotes:

*Note that the percentage figures do not exactly add up to the aggregate, which is especially visible with large swings in underlying data. Figures do add up on a logarithmic basis. For example, in logarithmic terms, gross value added in hotels and catering increased by 63% in Q2-21 compared to the previous quarter, while hours worked increased at 40%, and productivity at 23%.

**For a full of productivity performance by industry during the pandemic, see Klaas de Vries, Abdul Erumban and Bart van Ark, Productivity and the Pandemic: Short-Term Disruptions and Long-Term Implications. The impact of the COVID-19 pandemic on productivity dynamics by industry, The Productivity Institute, Working Paper No. 007, Manchester, 2021