Productivity Measurement Analysis series – Europe, Q3 2023 by Klaas de Vries

According to figures released on December 7 2023, labour productivity in the Euro Area, defined as real GDP per hour worked, was largely unchanged in the third quarter of 2023 compared to the previous quarter.[1] The common currency bloc noted a slight increase when the Irish figures are excluded from the aggregate, as the Irish GDP data tend to be quite volatile due to profit-shifting behaviour by US multinationals. In the remainder of this blog, we’ll use Euro Area data excluding Ireland when referring to the Euro Area aggregate.

Table 1. Euro Area (excl. Ireland)

| Q3/2023 | Q3/2023 | ||

| q/q | y/y | vs Q4 of 2019 | |

| Real GDP | 0,0% | 0,2% | 2,3% |

| Persons employed | 0,2% | 1,2% | 3,3% |

| Total hours worked | -0,1% | 1,2% | 2,1% |

| Labour productivity (per worker) | -0,2% | -1,0% | -0,9% |

| Labour productivity (per hour worked) | 0,1% | -1,0% | 0,3% |

Real GDP continues to flatline

The Euro Area economy has weakened substantially over the past few quarters under the weight of tighter monetary policy, slowing export markets and low consumer confidence. Real GDP basically flat-lined for the second and third quarters of 2023, and the prospects for the last quarter are not much better, even if inflation has moderated substantially in previous months. The weak economic environment is likely also slowly starting to spill over into the labour market.

Even as the total number of employees increased in the third quarter and the unemployment rate remains at a record low, average hours worked has declined. Employers are still adding workers but are asking them to put in fewer hours, which is likely a reflection of a weak demand environment. Therefore, the small increase in labour productivity in the third quarter over the previous quarter can be accounted for by decreased total hours worked and essentially unchanged real GDP.

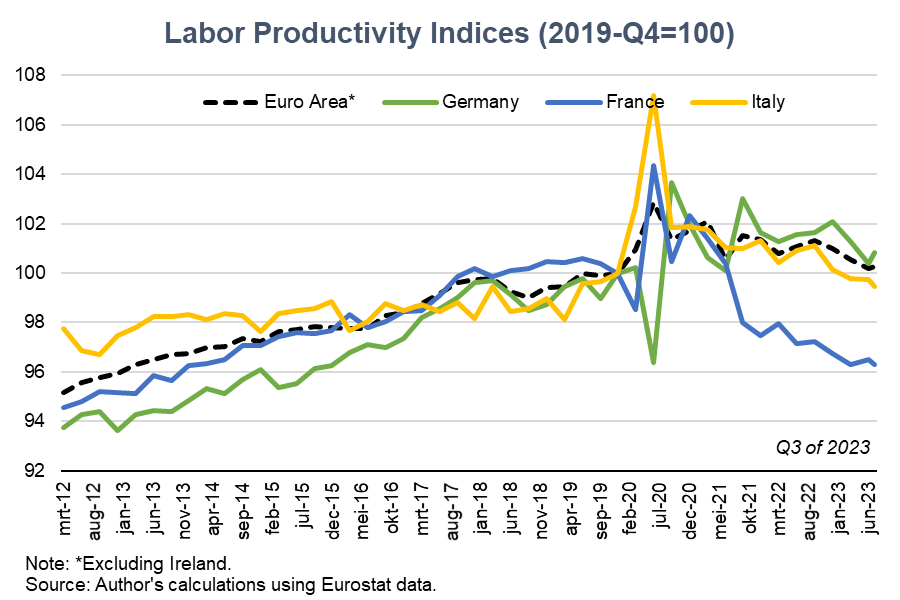

This data release does not alter the overall picture as it has emerged over the previous quarters in any fundamental way. Weak productivity growth is a common experience across economies in the bloc. Still, the weakness is most significant in the larger economies, particularly France, where productivity fell again in the third quarter.

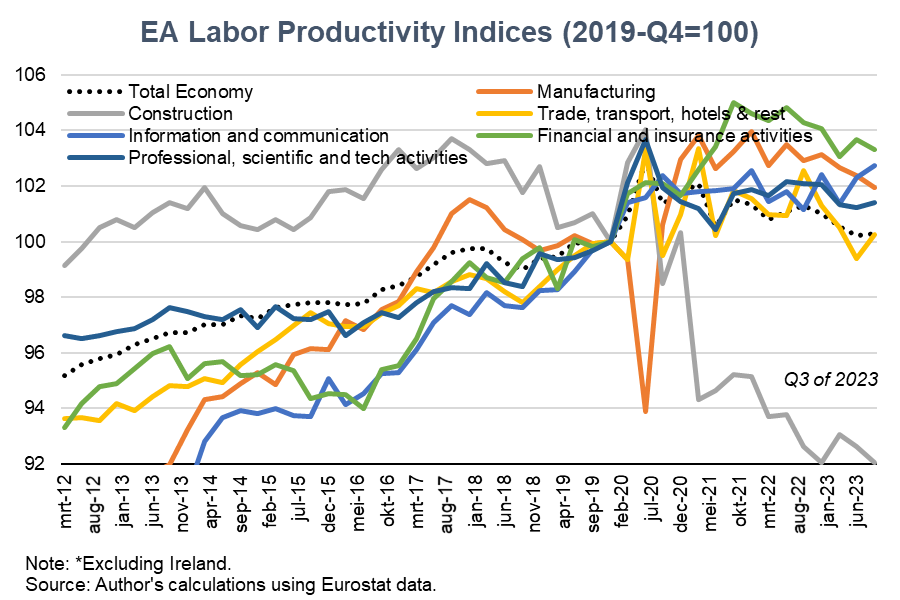

Euro Area productivity data by separate industries show a similar picture and widespread weakness, particularly in the construction sector. This industry’s average productivity level (in other words, the hours put in to produce GDP) is currently languishing 8 per cent below its pre-pandemic level (i.e., the last quarter of 2019). The sector hired aggressively over the past years, adding about 750 thousand workers since the last quarter of 2019, while its output declined over the same period.

Brighter prospects for the coming year

Are there no bright spots to note? Data for the fourth quarter are unlikely to show much of an improvement, so the year 2023 as a whole will be one to forget quickly regarding productivity growth. However, prospects for 2024 and beyond look somewhat better. Inflation is expected to continue to moderate while wage growth has started to pick up, which should bode well for demand.

Furthermore, a better interest rate environment may also positively impact the investment outlook. At the same time, new ways of working and technological breakthroughs may slowly start to bear fruit. This is all uncertain and still in the future. For now, the Euro Area continues to add workers but does not put them to use in a productive way.

[1] Real GDP at basic prices is used as the numerator, sometimes also referred to as Real Gross Value Added.