Overcoming barriers to digital platform adoption in the UK

By Myungun Kim, Yifeng (Philip) Chen, and Chander Velu

Digital platforms are heralded as catalysts for efficiency, innovation, and competitiveness. Yet, their adoption in the UK is uneven, particularly among smaller businesses and firms in less digitally mature regions. This blog explores the current landscape of digital platform adoption, the challenges firms face, and strategies to bridge the digital divide.

The promise and reality of digital platforms

Digital platforms, especially industrial ones, are often presented as transformative business models poised to reshape 21st-century industries. They promise enhanced productivity, seamless automation, and smarter decision-making. Examples like Siemens’ MindSphere illustrate the potential for revolutionising production through interoperability, real-time data analytics, and AI-driven optimisation.[1] However, despite these optimistic narratives, actual adoption patterns and impacts remain underexplored and poorly understood.

The lack of comprehensive nationwide studies on the diffusion and effectiveness of digital platforms only adds to the uncertainty surrounding their adoption. This gap leaves policymakers and industry leaders with an incomplete understanding of the platforms’ true potential and the specific challenges that need to be tackled for successful implementation.

A recent nationwide survey, titled Adoption of Digital Platforms: Insights from a UK National Survey, sheds new light on how digital platforms are being adopted across UK industries. This study not only highlights the impact of these platforms, but also uncovers the barriers that firms face. Building on discussions from a recent blog on digital technologies, we examine the practical challenges of platform adoption more closely, moving beyond theoretical benefits to explore practical challenges and their implications for industrial competitiveness.

Current state of digital platform adoption in the UK

While consumer-oriented platforms like e-commerce marketplaces and social media networks have transformed business-customer interactions, industrial platforms aim to enhance efficiency, coordination, and automation within and across firms. These platforms fall into two categories:

- Operations-Centred Platforms that focus on internal process optimisation, machine integration and service coordination within firms. They boost efficiency by streamlining workflows, enabling predictive maintenance and enhancing interoperability within firms across both industrial and service sectors.

- Distribution-Centred Platforms that facilitate external business-to-customer and business-to-business interactions, enabling supply chain integration and digital service delivery. They connect firms with suppliers, logistics providers and customers, helping the management of procurement, distribution and customer engagement.

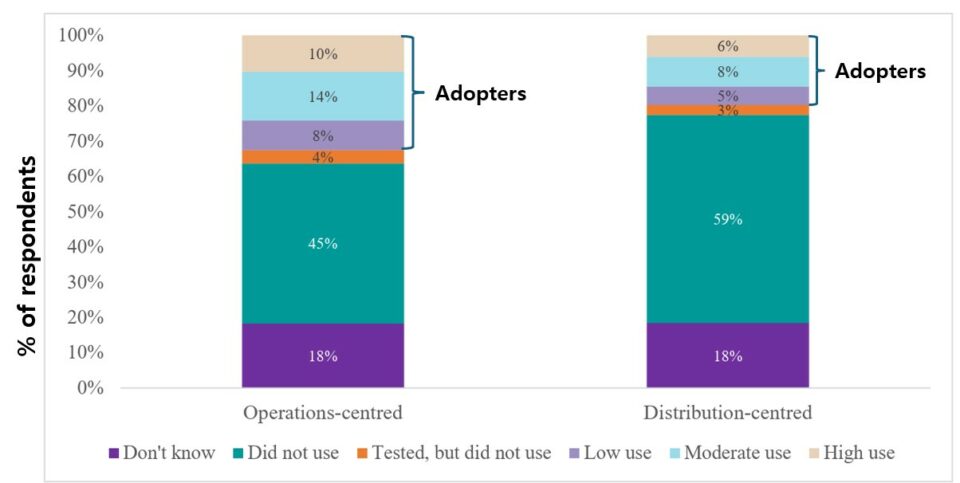

Despite their benefits, adoption rates are modest. Our survey of 3,175 firms reveals that 32% have adopted operations-centred platforms, but only 10% are high-intensity users. Similarly, 19% have adopted distribution-centred platforms, with just 6% being high-intensity users. These figures suggest that many firms remain hesitant or face barriers to integrating digital platforms into their operations.

Adoption Rates of Operations-centred and Distribution-centred Platforms

Note: Weighted sample (n= 3,175)

Large firms, service sectors, and economic hubs are biggest adopters

Adoption is skewed by firm size, sector and region, raising concerns about the effects an uneven diffusion of these technologies across the UK economy. Larger firms dominate, with 41% of businesses with over 250 employees using operations-centred platforms, compared to just 13% of firms with fewer than 10 employees. A similar gap exists for distribution-centred platforms, with 25% of large firms adopting them compared to only 10% of small firms.

Adoption Rates of Platforms by Firm Size

Note: Weighted sample (n= 3,175)

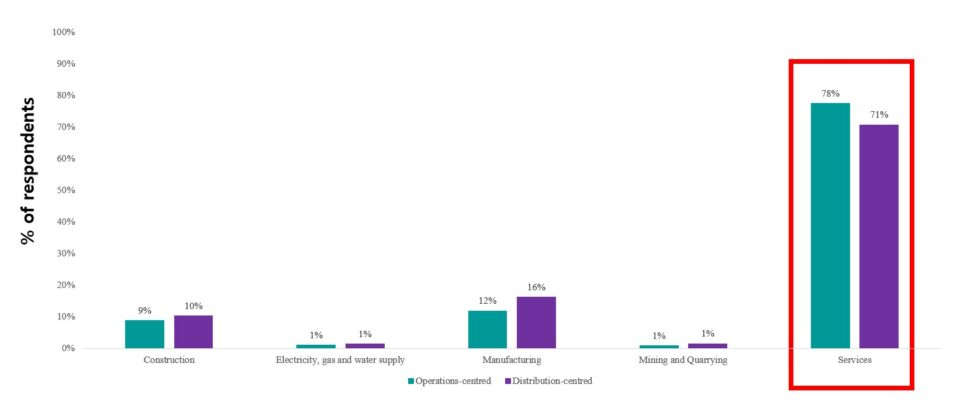

Sectoral differences further reinforce this divide. While the service sector leads in adoption, with 78% of operations-centred and 71% of distribution-centred platform adopters, the manufacturing sector, often touted as a key beneficiary of digitalisation, shows notably low adoption rates.

Adoption Rates of Platforms by Sector

Note: Weighted sample (n= 1,033 for operations-centred platforms, n = 725 for distribution-centred platforms)

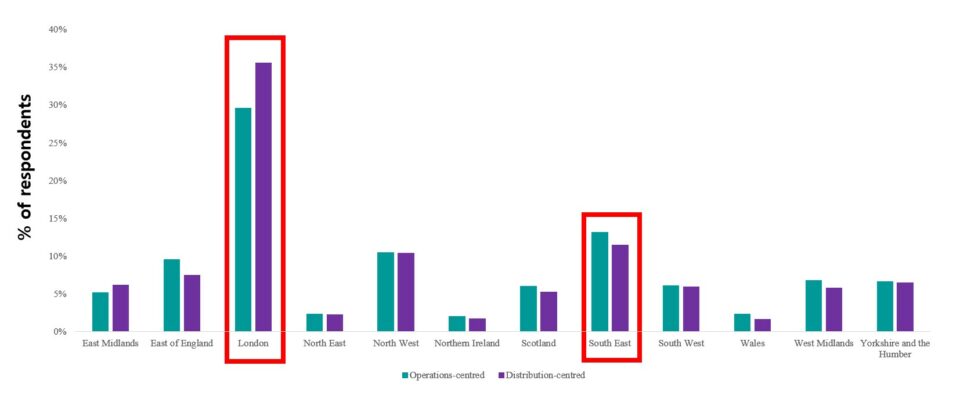

Geographical disparities add to this fragmentation. Adoption is heavily concentrated in London and the South East, while the North East and Wales lag behind, highlighting a North-South divide in digital transformation. Structural barriers like digital readiness, sectoral differences and resource constraints contribute to this uneven adoption, but our survey indicates there are additional factors at play.

Adoption Rates of Platforms by Region

Note: Weighted sample (n= 1,033 for operations-centred platforms, n = 725 for distribution-centred platforms)

Impact on business performance

Firms that have adopted digital platforms overwhelmingly report positive impacts on efficiency, innovation, customer satisfaction and market competitiveness, underscoring the transformative potential of digital platforms for firms willing to embrace them. Among firms using operations-centred platforms, 81% saw efficiency gains (“a lot” or “a little”) and 60% reported improvements in innovation, customer satisfaction and market competitiveness. Similarly, for distribution-centred platforms, 70 to 80 % of firms experienced positive outcomes.

Adoption of Operations-centred Platforms and Firm Performances

| Increased a lot |

Increased a little |

Neither increased nor decreased |

Decreased a little |

Decreased a lot |

|

| Efficiency | 31% | 50% | 13% | 3% | 1% |

| Innovation | 23% | 39% | 32% | 2% | 1% |

| Customer Satisfaction | 23% | 37% | 33% | 2% | 0% |

| Market Competitiveness | 20% | 41% | 32% | 3% | 1% |

Adoption of Distribution-centred Platforms and Firm Performances

| Increased a lot |

Increased a little |

Neither increased nor decreased |

Decreased a little |

Decreased a lot |

|

| Efficiency | 37% | 40% | 17% | 2% | 1% |

| Innovation | 36% | 37% | 23% | 1% | 0% |

| Customer Satisfaction | 35% | 38% | 23% | 2% | 0% |

| Market Competitiveness | 32% | 41% | 20% | 3% | 1% |

Note: Weighted sample (n = 1,033). A very small proportion of firms reported 'Don’t Know,' which has been excluded

However, approximately one in four firms saw no measurable improvement in key metrics such as market competitiveness and innovation, suggesting that adoption alone does not guarantee improved performance. Complementary investments in enabling technologies, organisational processes and workforce upskilling are crucial. Without these additional investments, digital platforms might not reach their full potential, limiting their ability to consistently boost productivity and competitiveness.

Unpacking the barriers to digital platform adoption

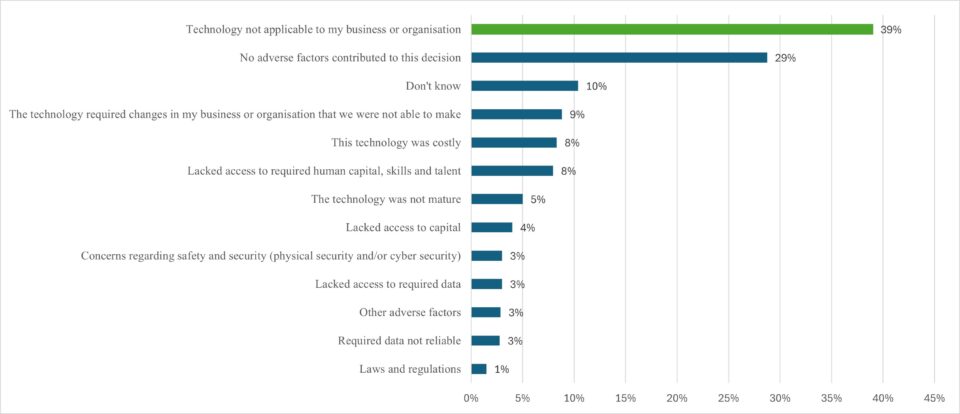

While high costs and a lack of skilled labour are often blamed for slow digital platform adoption, our findings suggest a key issue is the lack of awareness about their benefits and integration possibilities.

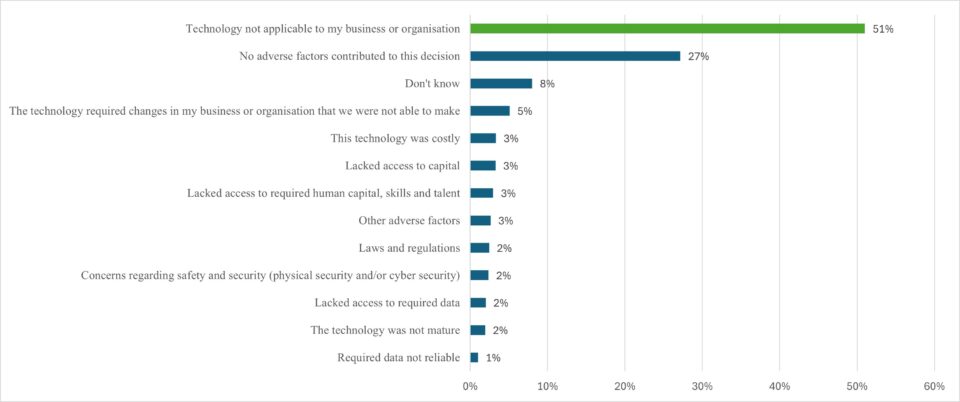

Our survey shows that 39% of non-adopters of operations-centred platforms and 51% of non-adopters of distribution-centred platforms think these technologies are not relevant to their business. This suggests many firms may not understand how these platforms could enhance their operations, especially those outside tech-intensive sectors.

Additionally, 27–29% of firms cited no specific barriers, indicating some firms haven’t actively considered platform adoption. For example, small-scale construction firms might assume digital platforms are designed for high-tech industries, overlooking tools like Procore or PlanGrid, which simplify project management and enhance coordination with minimal IT expertise required. Similarly, independent retailers and hospitality businesses might not recognise how platforms like Square or Toast can streamline payment processing, inventory management and customer engagement.

Barriers to Adoption for Operations-centred Platforms

Note : Weighted sample (n= 1,033 for operations-centred platforms, n = 725 for distribution-centred platforms)

Barriers to Adoption for Distribution-centred Platforms

Note : Weighted sample (n= 1,033 for operations-centred platforms, n = 725 for distribution-centred platforms)

These misconceptions about the complexity and relevance of digital platforms could be a significant factor limiting adoption. Clear industry-specific examples, targeted education and practical guidance could help businesses realise how these platforms can boost efficiency and competitiveness.

Bridging the digital platform adoption gap

Despite the benefits, digital platform adoption remains uneven, especially among smaller businesses and those outside digitally mature regions. Financial constraints and skills shortages are often cited as barriers, but perceived irrelevance and lack of awareness may be even greater obstacles. Many firms, particularly in sectors where digital transformation is not yet the norm, fail to see how these platforms could improve their operations.

Addressing this gap requires a targeted approach. Raising awareness through industry-specific case studies, financial incentives, regulatory support and tailored sectoral strategies can help. Bridging regional disparities is also crucial, ensuring that platform adoption extends beyond economic hubs like London and the South East.

However, awareness and adoption alone are not enough. Firms need the right capabilities, tools and complementary technologies to maximise the benefits of digital platforms. A purely sequential approach – first raising awareness, then focusing on adoption and only later addressing optimisation – is insufficient. Instead, a simultaneous and holistic strategy is required supporting businesses in adopting platforms and developing necessary infrastructure and skills from the outset.

Only by approaching digital transformation as an integrated process can firms fully leverage platform adoption to drive sustained business growth and competitiveness across the UK economy.

To find out more, read Adoption of Digital Platforms: Insights from a UK National Survey by Silvia Massini, Mabel Sanchez-Barrioluengo, Xiaoxiao Yu, Myungun Kim, Philip Chen and Chander Velu.

[1] Cusumano, M. A., Gawer, A., & Yoffie, D. B. (2019). The business of platforms: Strategy in the age of digital competition, innovation, and power (Vol. 320). New York: Harper Business.